|

|

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table |

|

|

|

|

|

|

|

|

|

|

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

NetREIT, Inc.

Dear Stockholder,

You are cordially invited to attendNOTICE IS HEREBY GIVEN that the Special2024 Annual Meeting of Stockholders (including any adjournments, postponements, or continuations thereof, “Annual Meeting”) of NetREIT,Presidio Property Trust, Inc., a Maryland corporation to(“Presidio” or the “Company”), will be held at 8:30 a.m., P.S.T., Monday, November 21, 2016 at the Company’s headquarters, 1282 Pacific Oaks Place, Escondido, California, 92029. as follows:

| TIME: | 8:30 A.M., Pacific Time |

| DATE: | June 27, 2024 |

| PLACE: | We will have a virtual meeting which you can attend by visiting https://agm.issuerdirect.com/sqft. There will be no physical location for in-person attendance at the Annual Meeting |

The attached notice of special meeting describes the business we will conduct and provides information about how to access the proxy materials that you should consider when you vote your shares.

At this special meeting, we will ask stockholders to consider and vote upon, on a non-binding, advisory basis, the compensation of our named executive officers as disclosed in the accompanying Proxy Statement pursuant to the compensation disclosure rules of the Securities and Exchange Commission. The Board of Directors recommends the approval of this proposal. We urge you to carefully review the Proxy Statement.

Whether you own a few or many shares, we hope youAnnual Meeting will be able to attendheld for the special meeting. Whether you plan to attend the special meeting or not, it is important that you cast your vote either in person or by proxy. None of our stockholders own more than 10% of our outstanding shares so every vote is important to us. Therefore, when you have finished reading the Proxy Statement, you are urged to vote in accordance with the instructions set forth in the Proxy Statement. We encourage you to authorize your vote by proxy so that your shares will be represented and voted at the meeting, whether or not you can attend. In order to make it easy to vote your shares, in addition to your proxy card we have added the ability for you to authorize your proxy by telephone or through the Internet.

YOUR VOTE MATTERS. We urge you to review the 2015 Annual Report to Stockholders and this Proxy Statement and authorize your vote via phone or Internet at www.proxypush.com/NetREIT or mark, sign, date, and return your enclosed proxy card in the postage paid envelope so your shares will be represented at the meeting.

Thank you for your ongoing support of NetREIT, Inc. We look forward to seeing you at our special meeting.following purposes:

| 1. | To elect as directors of the Company the two nominees of the Company’s Board of Directors (the “Board”) named in the attached Proxy Statement, each to serve until the 2027 Annual Meeting of Stockholders and until their respective successors have been duly elected and qualified; |

| |

| |

| |

|

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TIME: 8:30 a.m., P.S.T.

DATE: November 21, 2016

PLACE: 1282 Pacific Oaks Place, Escondido, California, 92029

PURPOSE:

| To consider and vote upon |

| 3. | To consider and vote upon an amendment to the Company’s charter to provide for the reclassification of any unissued shares of common stock from time to time into one or more classes or series of stock having such terms as determined by the Board; |

| 4. | To consider and vote upon an amendment to the Company’s charter to eliminate cumulative voting in the |

| 5. | To transact such other business as may properly come before the |

The foregoing itemitems of business isare more fully described in the attached Proxy Statement, which forms a part of this notice and is incorporated herein by reference. You are encouraged to read the Proxy Statement before voting or authorizing a proxy to vote on your behalf.

WHO MAY VOTE:

Our BoardWho Can Vote:

Stockholders of Directors has fixedrecord at the close of business on September 23, 2016May 1, 2024 (the “Record Date”).

How You Can Vote:

You may cast your vote via mail, telephone, or the Internet. Certain stockholders may only be able to vote by mail. You may also vote virtually at the Annual Meeting.

| i |

Who May Attend:

All stockholders as of the Record Date and their proxy holders are cordially invited to attend the Annual Meeting by visiting https://agm.issuerdirect.com/sqft, where you will be able to listen to the meeting live, submit questions, and vote. To attend the Annual Meeting, you must pre-register at https://agm.issuerdirect.com/sqft by 8:15 A.M., Pacific Time on June 27, 2024.

Whether or not you attend the Annual Meeting, it is important that your shares be represented at the Annual Meeting. We encourage you to please vote TODAY to ensure your voice is heard. You may vote by marking, signing, and dating the enclosed proxy card and returning it in the postage-paid envelope. Stockholders may also vote via the Internet or by telephone.

For more information and up-to-date postings, please go to www.presidiopt.com. Information on our website is not, and will not be deemed to be, a part of this Proxy Statement or incorporated into any of our other filings with the Securities and Exchange Commission. If you need assistance with voting or have any questions, please contact Morrow Sodali, LLC (“Morrow Sodali”), our proxy solicitor assisting us in connection with the Annual Meeting. Stockholders may call toll free at (800) 662-5200. Banks, brokers, and other nominees may call collect at (203) 658-9400.

Regardless of the number of shares of Presidio common stock that you own, your vote is important. Thank you for your continued support, interest, and investment in Presidio.

| BY ORDER OF THE BOARD OF DIRECTORS | |

| /s/ Jack K. Heilbron | |

| Chairman of the Board, Chief Executive Officer, and President | |

| San Diego, CA | |

| May 10, 2024 |

This Notice of the Annual Meeting of Stockholders and the accompanying Proxy Statement will first be sent or made available to stockholders of record as of the close of business on May 1, 2024 on or about May 10, 2024.

If you have any questions or require any assistance in voting your shares, please contact our proxy solicitor:

509 Madison Avenue Suite 1206

New York, NY 10022

Stockholders Call Toll Free: (800) 662-5200

Banks, Brokers, Trustees, and Other Nominees Call Collect: (203) 658-9400

Email: SQFT@investor.MorrowSodali.com

| ii |

4995 Murphy Canyon Road, Suite 300

San Diego, California 92123

PROXY STATEMENT

INTRODUCTION

This proxy statement (including all appendices attached hereto, this “Proxy Statement”) and the enclosed proxy card are being furnished to stockholders in connection with the solicitation of proxies by the Board of Directors (the “Board” or the “Board of Directors”) of Presidio Property Trust, Inc., a Maryland corporation (“Presidio,” the “Company,” “we,” “us” or “our”), for use at Presidio’s Annual Meeting of Stockholders (including any adjournments, postponements, or continuations thereof, the “Annual Meeting”). We anticipate that this Proxy Statement and the enclosed form of proxy card will first be sent or made available to stockholders of record as of the close of business on May 1, 2024 on or about May 10, 2024.

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this Proxy Statement. As this summary does not contain all of the information that you should consider, we encourage you to carefully read the entire Proxy Statement for more information before voting.

THE 2024 ANNUAL MEETING

Annual Meeting of Stockholders

| TIME: | 8:30 A.M., Pacific Time. | |

| DATE: | June 27, 2024. | |

| PLACE: | We will have a virtual meeting which you can attend by visiting https://agm.issuerdirect.com/sqft. There will be no physical location for in-person attendance at the Annual Meeting. | |

| RECORD DATE: | The close of business on May 1, 2024 (the “Record Date”). | |

| PROXY MATERIALS: | The Notice of the Annual Meeting of Stockholders, this Proxy Statement, the accompanying proxy card, and Presidio’s Annual Report on Form 10-K for the year ended December 31, 2023 will first be sent or made available to stockholders of record as of the Record Date on or about May 10, 2024. |

Proposals and Board Recommendations for Voting

| PROPOSAL | RECOMMENDATION ON THE PROXY CARD | PAGE |

| Proposal 1 - To elect as directors of the Company the two nominees of the Company’s Board of Directors (the “Board”) named in this Proxy Statement, each to serve until the 2027 Annual Meeting of Stockholders and until their respective successors have been duly elected and qualified. | “FOR ALL” | 12 |

| Proposal 2 - To consider and vote upon the ratification of the appointment of Baker Tilly US, LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024. | “FOR” | 45 |

| Proposal 3 - To consider and vote upon an amendment to the Company’s charter to provide for the reclassification of any unissued shares of common stock from time to time into one or more classes or series of stock having such terms as determined by the Board. | “FOR” | 46 |

| Proposal 4 - To consider and vote upon an amendment to the Company’s charter to eliminate cumulative voting in the election of directors. | “FOR” | 47 |

Whether or not you attend the Annual Meeting, it is important that your shares be represented at the Annual Meeting. We encourage you to please vote TODAY to ensure your voice is heard. You may vote by marking, signing, and dating the enclosed proxy card and returning it in the postage-paid envelope. Stockholders may also vote via the Internet or by telephone.

For more information and up-to-date postings, please go to www.presidiopt.com. Information on our website is not, and will not be deemed to be, a part of this Proxy Statement or incorporated into any of our other filings with the SEC. If you need assistance with voting or have any questions, please contact Morrow Sodali, the proxy solicitation firm assisting us in connection with the Annual Meeting. Stockholders may call toll free at (800) 662-5200. Banks, brokers, and other nominees may call collect at (203) 658-9400.

Regardless of the number of shares of Presidio common stock that you own, your vote is important. Whether or not you plan to participate in our virtual Annual Meeting, we urge you to submit your proxy as soon as possible to ensure your shares are represented and voted at the Annual Meeting. Thank you for your continued support, interest, and investment in Presidio.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

Why am I receiving these proxy materials?

You received these proxy materials because you are a stockholder of Presidio. The Board is providing these proxy materials to you in connection with Presidio’s Annual Meeting to be held on June 27, 2024 at 8:30 A.M., Pacific Time, via live webcast at https://agm.issuerdirect.com/sqft. These materials will first be sent or made available to stockholders of record as of the Record Date on or about May 10, 2024. You are invited to attend the Annual Meeting and are requested to vote on the proposals described in this Proxy Statement.

These materials also include a voting instruction form or proxy card for the Annual Meeting. Voting instruction forms and proxy cards are being solicited on behalf of the Board. Presidio’s proxy materials include detailed information about the matters that will be discussed and voted on at the Annual Meeting and provide updated information about Presidio that you should consider in order to make an informed decision when voting your shares.

When and where will the Annual Meeting be held?

The Annual Meeting is scheduled to be held on June 27, 2024 at 8:30 A.M., Pacific Time, in a virtual only meeting format via live webcast at https://agm.issuerdirect.com/sqft. You will not be able to attend the Annual Meeting at a physical location. To attend the Annual Meeting, you must pre-register at https://agm.issuerdirect.com/sqft by 8:15 A.M., Pacific Time on June 27, 2024. Attendance at the Annual Meeting will be limited to stockholders as of the Record Date, their proxy holders, and invited guests of Presidio. Access to the Annual Meeting may be granted to others at the discretion of Presidio and the chair of the Annual Meeting.

Please have your voting instruction form, proxy card, or other communication containing your control number available and follow the instructions to complete your registration request. Upon completing registration, participants will receive further instructions via email, including unique links that will allow them to access the Annual Meeting.

Stockholders may log into the meeting platform beginning at 8:15 A.M., Pacific Time, on June 27, 2024. We encourage you to log in prior to the Annual Meeting’s start time by following the instructions found in the reminder email sent the day before the Annual Meeting.

If you are a beneficial holder, you must obtain a “legal proxy” from your broker, bank, or other nominee in order to vote at the Annual Meeting. If you need assistance with registration or voting, or have any questions, please contact Morrow Sodali, our proxy solicitor assisting us in connection with the Annual Meeting.

We will provide stockholders with the opportunity to ask questions via the virtual meeting platform. Instructions for submitting questions and making statements will be posted on the virtual meeting platform.

Even if you plan to attend the Annual Meeting, we strongly urge you to vote in advance either by completing, signing, and dating the enclosed voting instruction form or proxy card and returning it in the postage-paid envelope provided or by voting via the Internet or by telephone, as soon as possible. This will ensure your vote will be counted if you later are unable or decide not to attend the Annual Meeting.

What if I experience technical issues with the virtual meeting platform?

We will have technicians ready to assist you with any technical difficulties you may have while accessing the virtual Annual Meeting. If you encounter any difficulties accessing the virtual meeting during check-in or during the Annual Meeting, please call the technical support number that will be included in the reminder email you will receive the day before the meeting. We encourage you to access the virtual meeting prior to the start time. If you need assistance with registration, voting or have any questions, please contact Morrow Sodali, our proxy solicitor assisting us in connection with the Annual Meeting.

What is a proxy?

A proxy is your legal designation of another person (your “proxy”) to vote the shares of common stock you own at the Annual Meeting. By completing and returning the proxy card(s), which identify the individuals authorized to act as your proxy, you are giving each of those individuals the authority to vote your shares of common stock as you have instructed. By voting via proxy, each stockholder is able to cast his or her vote without having to attend the Annual Meeting.

Our Board is asking you to give your proxy to Jack K. Heilbron, our Chairman of the Board, Chief Executive Officer, and President, and Ed Bentzen, our Chief Financial Officer. Giving your proxy to Messrs. Heilbron and Bentzen means that you authorize them, either of them, or their duly appointed substitutes or re-substitutes to vote your shares at the Annual Meeting in accordance with your instructions.

Why did I receive more than one proxy card?

You will receive multiple proxy cards if you hold your shares of common stock in different ways (e.g., different names, trusts, custodial accounts, joint tenancy) or in multiple accounts. If your shares of common stock are held by a broker or bank (i.e., in “street name”), you will receive your proxy card and other voting instructions directly from your brokerage firm, bank, trust, or other nominee. It is important that you complete, sign, date and return each proxy card you receive, or vote via the Internet or by telephone as described in the instructions included with your proxy card(s).

What matters will be voted on at the Annual Meeting?

We are aware of four matters that stockholders may vote on at the Annual Meeting. The following items are each listed on the proxy card:

| ● | Proposal 1 - To elect as directors of the Company the two nominees named in this Proxy Statement, each to serve until the 2027 Annual Meeting of Stockholders and until their respective successors have been duly elected and qualified; | |

| ● | Proposal 2 - To consider and vote upon the ratification of the appointment of Baker Tilly US, LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024; | |

| ● | Proposal 3 - To consider and vote upon an amendment to the Company’s charter to provide for the reclassification of any unissued shares of common stock from time to time into one or more classes or series of stock having such terms as determined by the Board; and | |

| ● | Proposal 4 - To consider and vote upon an amendment to the Company’s charter to eliminate cumulative voting in the election of directors. |

We will also transact such other matters as may properly come before the Annual Meeting.

Could other matters be decided at the Annual Meeting?

The Board does not intend to present to the Annual Meeting any business other than the proposals described in this Proxy Statement. Our Board is not aware of any other business to be presented for action at the Annual Meeting. However, if any other matters properly come before the Annual Meeting, the individuals named as proxies on the enclosed proxy card, or their duly constituted substitutes acting at the Annual Meeting, will be authorized to vote or otherwise act thereon in accordance with their discretion on such matters to the extent authorized by Rule 14a-4(c) of the Exchange Act.

What are the Board’s voting recommendations?

The Board unanimously recommends that you vote your shares using the enclosed proxy card:

| ● | “FOR ALL” two of the Board’s highly qualified and very experienced nominees to be elected to serve on the Board until the 2027 Annual Meeting of Stockholders and until their respective successors have been duly elected and qualified (Proposal 1); | |

| ● | “FOR” the ratification of the appointment of Baker Tilly US, LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024 (Proposal 2); | |

| ● | “FOR” an amendment to the Company’s charter to provide for the reclassification of any unissued shares of common stock from time to time into one or more classes or series of stock having such terms as determined by the Board (Proposal 3); and | |

| ● | “FOR” an amendment to the Company’s charter to eliminate cumulative voting in the election of directors. (Proposal 4). |

All shares represented by validly executed proxy cards received prior to the taking of the vote at the Annual Meeting will be voted by the designated proxy holders and, where a stockholder specifies by means of the proxy card a choice with respect to any matter to be acted upon, the shares will be voted in accordance with the stockholder’s instructions.

THE BOARD RECOMMENDS A VOTE “FOR ALL” OF OUR BOARD’S HIGHLY QUALIFIED AND VERY EXPERIENCED NOMINEES LISTED ON THE ENCLOSED PROXY CARD. If you indicate on your proxy card, via the Internet or by telephone, that you want to withhold authority to vote for a particular nominee, then your shares will not be voted for that nominee.

We do not expect any additional matters to be presented for action at the Annual Meeting other than the matters described in this Proxy Statement. However, by either signing, dating, and returning your proxy card or following the instructions on the enclosed proxy card to submit your proxy and voting instructions via the Internet or by telephone, you will give to the persons named as proxies discretionary voting authority, to the extent authorized by Rule 14a-4(c) of the Exchange Act, with respect to any other matter that may properly come before the Annual Meeting.

Do I have to attend the Annual Meeting to vote?

No. If you want to have your vote count at the Annual Meeting, but not actually attend the meeting, you may vote by granting a proxy or—for beneficial owners (i.e., “street name” stockholders)—by submitting voting instructions to your broker, bank, or other nominee. In most instances, you will be able to do this via the Internet, by telephone, or by mail.

In the United States, if you are not in possession of your voting proxy or instruction form, please contact your broker or bank for assistance in obtaining a duplicate control number.

How may I obtain a paper copy of the proxy materials?

To receive, free of charge, a separate paper copy of this Proxy Statement or Presidio’s 2023 Annual Report, stockholders may write or call our offices at the following address or telephone number:

Presidio Property Trust, Inc.

Attn: Investor Relations

4995 Murphy Canyon Road, Suite 300

San Diego, California 92123

760-471-8536

Beneficial owners (i.e., “street name” stockholders) may contact their brokerage firm, bank, or other similar organization to request information.

What is the Record Date and what does it mean?

Our Board established the close of business on May 1, 2024 as the record dateRecord Date for the determinationAnnual Meeting to be held on June 27, 2024. Stockholders of stockholdersrecord at the close of business on the Record Date are entitled to notice of and to vote at the special meetingAnnual Meeting.

What is the difference between a “registered stockholder” and a “street name stockholder?”

These terms describe how your shares of common stock are held.

If your shares of common stock are registered directly in your name with Issuer Direct—Presidio’s transfer agent—you are a stockholder of record (also known as a “registered stockholder”).

If your shares of common stock are held in the name of a brokerage, bank, trust, or any adjournmentother nominee as a custodian, you are a beneficial owner (i.e., a “street name” stockholder). As a beneficial owner, you have the right to instruct the broker, bank, or postponement thereof.

Pursuantother nominee on how to vote the shares of common stock in your account. Please refer to the rulesvoting instructions provided by your bank, broker, or other nominee to direct it how to vote your shares. You are also invited to attend the Annual Meeting. However, because you are not the stockholder of record, you will not be able to vote the Securities and Exchange Commission, we have elected to furnish proxy materials to our stockholders over the Internet. Alternatively, weshares of which you are sending full set proxy materials to some of our stockholders and to any stockholder who has elected to receive proxy materials by mail. We believe that this combination of the e-proxy process and the full set mailing will ensure our stockholders’ receipt of proxy materials, lower the cost of the proxy and mailing, reduce the environmental impact of our special meeting, and help ensure that we can meet quorum. Accordingly, we will send either a Notice of Internet Availability of Proxy Materials or a full set of proxy materials on or about October 11, 2016, and provide access to our proxy materials over the Internet beginning on October 7, 2016 for the beneficial ownersowner electronically at the Annual Meeting unless you obtain a legal proxy from the stockholder of ourrecord authorizing you to vote the shares.

How many shares of common stock asare entitled to vote at the Annual Meeting?

As of the close of business on May 1, 2024, the record date. If you receive a NoticeRecord Date, there were approximately 14,463,802 shares of Internet AvailabilitySeries A Common Stock outstanding. No shares of Proxy Materials by mail, you will not receive a printed copySeries C Common Stock have been issued. Each share of common stock entitles the holder thereof to one vote for as many individuals as there are directors to be elected at the Annual Meeting and one vote on each other matter that is properly brought before the Annual Meeting.

How many votes must be present to hold the Annual Meeting?

A majority of the proxy materials inshares of common stock entitled to vote at the mail. Instead,Annual Meeting must be represented electronically (given the Noticevirtual nature of Internet Availability of Proxy Materials instructs you on how to access and review this Proxy Statement and our annual report, how to authorize your proxy onlinethe Annual Meeting) or by telephone, and howproxy at the Annual Meeting to receiveconstitute a printed copyquorum for the transaction of our proxy materials.business. For purposes of determining whether a quorum is present, each share of common stock is deemed to entitle the holder to one vote per share.

Your proxy is important. Whether or not you plan to attend the special meeting, please authorize your proxy by Internet or telephone, or, if you received a paper copy of the materials by mail, by marking, signing, dating and returning your proxy card, so that your shares will be represented at the special meeting. If you plan to attend the special meeting and wish to vote your shares personally, you may do so at any time before the proxycounted for purposes of determining if there is voted.

All stockholders are cordially invited to attend the meeting.a quorum if you:

| ● | Are entitled to vote and are present at the virtual Annual Meeting; or |

|

| |

| ||

| ||

| ||

NetREIT, Inc.

1282 Pacific Oaks Place

Escondido, California 92029

PROXY STATEMENT

FOR

SPECIAL MEETING OF STOCKHOLDERS

To Be Held on November 21, 2016 at 8:30 a.m. P.S.T.

This Proxy Statement is furnished toAbstentions and broker non-votes are counted as present for purposes of determining the stockholderspresence of NetREIT, Inc. a Maryland corporation, in connection with the solicitation by the Board of Directors of the Company (the “Board” or “Board of Directors”) of your proxy to be voted at the special meeting of the stockholders of the Company (the “Special Meeting”) to be held on Monday, November 21, 2016 at 8:30 a.m., P.S.T., at our corporate headquarters, 1282 Pacific Oaks Place, Escondido, California, 92029 and at any postponement or adjournment thereof. References in this Proxy Statement to “the Company,” “NetREIT,” “we,” “us,” “our” or like terms also refer to NetREIT, Inc. The mailing address of our corporate office is 1282 Pacific Oaks Place, Escondido, California 92029. As described in detail in this Proxy Statement, in addition to mailing copies of our proxy materials to our stockholders, we have chosen to also deliver this Proxy Statement, its accompanying proxy materials, and our 2015 Annual Report (the “Annual Report”) electronically by posting them on our website and mailing either Notices of Internet Availability of Proxy Materials or full set proxy materials to stockholders on or about October 11, 2016. This Proxy Statement and the accompanying proxy materials (together with our Annual Report) are also posted on our website at www.netreit.com.

At the Company’s 2013 Annual Meeting of Stockholders, the stockholders approved holding a say-on-pay advisory vote once every three years. In accordance with such vote, the Company is submitting the say-on-pay resolution set forth in this Proxy Statement to a stockholder vote at the Special Meeting, as the say-on-pay proposal was not included in the proxy statement for the Company’s 2016 Annual Meeting of Stockholders. The Compensation Narrative set forth in this Proxy Statement is identical in all material respects to the compensation disclosure included in the proxy statement for the Company’s 2016 Annual Meeting of Stockholders.

Important Information Regarding Delivery of Proxy Materials

What is “Notice and Access”?

“Notice and access” generally refers to rules governing how companies must provide proxy materials. Under the notice and access model, a company may select either of the following two options for making proxy materials available to stockholders:

|

|

|

|

A company may use a single method for all its stockholders, or use full set delivery for some while adopting the notice only option for others.

What is the Full Set Delivery Option?

Under the full set delivery option, a company delivers all proxy materials to its stockholders. This delivery can be by mail or, if a stockholder has previously agreed, by e-mail. In addition to delivering proxy materials to stockholders, the company must also post all proxy materials on a publicly accessible website and provide information to stockholders about how to access that website.

What is the Notice Only Option?

Under the notice only option, a company must post all its proxy materials on a publicly accessible website and deliver a Notice of Internet Availability of Proxy Materials. The notice includes, among other matters:

|

|

|

|

|

|

If a stockholder requests paper copies of the proxy materials, we will send these materials to the stockholder within three business days via first class mail.

In connection with its Special Meeting, NetREIT has elected to use both the Notice Only option and the Full Set option. Accordingly, you should have received either the NetREIT Notice of Internet Availability of Proxy Materials by mail which included instructions on how to access and view the materials and vote online or by telephone, or a full set paper copy of the Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 2015.

You may view your proxy materials, including our Annual Report and proxy card online by going to www.proxydocs.com/NetREIT. If you received Notice Only and prefer a paper copy of the proxy materials, you may request one by calling 1-866-648-8133, by email at paper@investorelections.com, or via the internet at www.investorelections.com/NetREIT. You will also have the opportunity to make a request to receive paper copies for all future meetings or only for the Special Meeting.

PURPOSE OF THE MEETING

At the Special Meeting, the stockholders of the Company will be asked:

|

|

QUORUM

The presence, in person or by proxy, of stockholders entitled to cast a majority of the votes entitled to be cast on a matter will constitute a quorum at the SpecialAnnual Meeting. Votes “for”For additional information regarding broker non-votes, please see “How do abstentions, against votes, broker non-votes, withhold votes, and “against,unmarked proxy cards affect the voting results?” “abstentions”, and “broker non-votes” will all be counted as present to determine whether a quorum has been established. in the Proxy Statement.

If a quorum is not present at the Annual Meeting, the chairman of the meeting or the stockholders entitled to vote at the SpecialAnnual Meeting, present in person or by proxy, may adjourn the SpecialAnnual Meeting, one or more times until a quorum is deemed to be present, to a date not more than sixty (60)120 days after the original record date of May 1, 2024, without notice other than announcement at the meeting. The persons named as proxies will vote in favor of any such adjournment.

VOTING RIGHTS

Only holders of record of outstandingThe NYSE rules applicable to brokers, banks, and other nominees that are NYSE members determine whether your broker, bank, or other nominee may vote your shares of our common stock atin its discretion even if it does not receive voting instructions from you. These rules apply even for companies that are, like Presidio, listed on the close of business on September 23, 2016Nasdaq Stock Market LLC (“Nasdaq”), since the rules apply to the banks, brokers, and other nominees that are entitled to receive notice of and to vote atNYSE members. Since Presidio’s proposal for the Special Meeting or any postponement or adjournmentratification of the meeting. Asappointment of the record date, there were issued and outstanding 17,374,767.749 shares of common stock. Each share of common stock entitles the holder thereof to one vote on each matter properly brought before the Special Meeting.

VOTING PROCEDURES

Abstentions from voting on the proposal and broker non-votes, if any, are considered presentBaker Tilly US, LLP, as Presidio’s independent registered public accounting firm for the purpose of determiningfiscal year ending December 31, 2024 (Proposal 2) is regarded by the presence ofNYSE as a quorum. A “broker non-vote” occurs when a bank, broker, or“routine” proposal, brokers, banks, and other holder of record holding shares for a beneficial owner does not vote because that holder does notnominees will have discretionary voting power and has not received voting instructions fromauthority at the beneficial owner. Brokers do not have the discretionAnnual Meeting with respect to Proposal 2.

Should a broker, bank, or other nominee exercise its discretionary authority to vote your shares of common stock with respect to Proposal 2 in the absence of instructions from you, such uninstructed shares will be counted for purposes of determining whether a quorum exists at the Special Meeting without receiving voting instructions from you. AsAnnual Meeting. However, please be advised that it is possible that a result, if you don’t complete the voting instructions, your votes will not be cast for the proposal to approve, on a non-binding, advisory basis, the compensation of our named executive officers.

Telephone and Internet voting for all stockholders of record will be available 24-hours a day, and will close at 11:59 p.m., P.S.T., on Sunday, November 20, 2016. Attendance at the Special Meeting will not revoke a previously submitted proxy unless you actually vote in person at the meeting. For shares you hold beneficially in street name, you may change your vote by submitting a new voting instruction to your broker, bank, or other nominee following the instructions they provided, or,may choose not to exercise discretionary authority with respect to Proposal 2. In that case, if you have obtained a legal proxy fromdo not instruct your broker, bank, or other nominee giving you the righthow to vote your shares of common stock with respect to Proposal 2, such broker, bank, or other nominee may choose not to vote your uninstructed shares with respect to Proposal 2 and, accordingly, such uninstructed shares would not be voted or counted for determining whether a quorum exists at the Annual Meeting.

A properly executed and valid proxy marked “withhold” with respect to the election of one or more of Presidio’s director nominees will also be counted as present for purposes of determining if there is a quorum present at the Annual Meeting.

What vote is required to approve each proposal?

Proposal 1 – Election of Directors. Voting for the election of directors in Proposal 1 will be cumulative if, prior to commencement of the voting, a stockholder gives us notice of his or her intention to cumulate votes. If any stockholder gives such a notice, then every stockholder will be entitled to such rights, in which case, you may cumulate your total votes and cast all of your votes for any one or a combination of director nominees. In cumulative voting, your total votes equal the number of director nominees multiplied by attending the Specialnumber of shares of common stock that you are entitled to vote. In the event that a quorum is not present at the Annual Meeting and, accordingly, business cannot be conducted at the meeting, each of the Company’s current Class I directors, David T. Bruen and Steve Hightower, will remain in office and continue to serve until their successors are duly elected and qualify. You may vote FOR or WITHHOLD your vote from any one or more of the nominees. In the event of cumulative voting, the two nominees for the Board who receive the most votes will be elected. If no stockholder provides notice of an intention to cumulate votes in person.the election of directors, directors will be elected by a plurality of all the votes cast at a meeting in which directors are being elected. If you do not instruct your bank or broker how to vote with respect to this item, your bank or broker may not vote with respect to the election of directors.

VOTE REQUIRED

ApprovalProposal 2 – Ratification of Proposal 1 requires the Appointment of Baker Tilly US, LLP. The affirmative vote of a majority of the votes cast is required to ratify the appointment of Baker Tilly US, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024. If the stockholders do not ratify the appointment, the Audit Committee of the Board (the “Audit Committee”) will consider the results and any information submitted by the stockholders in determining whether to retain Baker Tilly US, LLP as Presidio’s independent registered public accounting firm for the fiscal year ending December 31, 2024. Even if the appointment is ratified, the Audit Committee, in its discretion, may change the appointment at any time during the year if it determines that a change would be in the best interests of Presidio.

Proposal 3 – Amendment to the Company’s charter to provide for the reclassification of any unissued shares of common stock represented in personfrom time to time into one or more classes or series of stock having such terms as determined by proxy at the Special Meeting andBoard of Directors. The affirmative vote of the holders of a majority of all of the votes entitled to be cast on the matter is required to approve an amendment to our charter to provide for the reclassification of any unissued shares of common stock from time to time into one or more classes or series of stock having such terms as determined by the Board of Directors.

Proposal 4 - Amendment to the Company’s charter to eliminate cumulative voting in the election of directors. The affirmative vote thereon. of the holders of a majority of all of the votes entitled to be cast on the matter is required to approve an amendment to our charter to eliminate cumulative voting in the election of directors.

How do abstentions, against votes, broker non-votes, withhold votes, and unmarked proxy cards affect the voting results?

Abstentions and Broker Non-Votes.

Proposal 1 – Election of Directors. In the event of cumulative voting or if votes are not cumulated for the election of directors, abstentions, and withhold votes, if any, will have no effect on the outcome of Proposal 1. Broker discretionary voting is not permitted with respect to Proposal 1, and broker non-votes will have no effect on the outcome of Proposal 1.

Proposal 2 – Ratification of the Appointment of Baker Tilly US, LLP. Abstentions are not considered votes cast and, accordingly, will have no effect on the outcome of Proposal 2. Broker non-votes, if any, will also have no effect on the outcome of Proposal 2 although they will be considered present for the purpose of determining the presence of a quorum. Your broker, bank, or other nominee will have discretionary authority at the Annual Meeting to vote your shares of common stock with respect to Proposal 2 without voting instructions from you and, accordingly, we do not currently expect that broker non-votes will be applicable to Proposal 2. However, please be advised that it is possible that a broker, bank, or other nominee may choose not to exercise discretionary authority with respect to Proposal 2. In that case, if you do not instruct your broker, bank, or other nominee how to vote your shares of common stock with respect to Proposal 2, it is possible that such broker, bank, or other nominee may choose not to vote your uninstructed shares with respect to Proposal 2 and, accordingly, such uninstructed shares would not be voted or counted for determining whether a quorum exists at the Annual Meeting.

Proposal 3 – Amendment to the Company’s charter to provide for the reclassification of any unissued shares of common stock from time to time into one or more classes or series of stock having such terms as determined by the Board of Directors. Abstentions and therefore,broker non-votes, if any, will have the same effect as votes against Proposal 3, although they will be considered present for the purpose of determining the presence of a quorum.

Proposal 4 - Amendment to the Company’s charter to eliminate cumulative voting in the election of directors. Abstentions and broker non-votes, if any, will have the same effect as votes against Proposal 4, although they will be considered present for the purpose of determining the presence of a quorum.

Brokers, banks, and other nominees will be able to exercise discretionary authority to vote againstyour uninstructed shares of common stock with respect to Proposal 2, but will not be able to exercise discretionary authority with respect to any of the proposal.other proposals described in this Proxy Statement. Therefore, we expect that there will be broker non-votes with respect to such other proposals.

SOLICITATION OF PROXIES

Unmarked Proxy Cards.If you cannot attendsign and return the meeting, the accompanyingenclosed proxy card shouldor otherwise vote as directed herein, but do not mark how your shares are to be used to instructvoted, the personsindividuals named as proxies toon such proxy card will vote your shares in accordance with your directions. The persons namedthe recommendation of the Board on the four (4) proposals described in the accompanyingthis Proxy Statement. Accordingly, if no direction is made, an unmarked but signed proxy card will vote shares represented by all valid proxies in accordance with the instructions contained therein. In the absence of instructions, shares represented by properly executed proxies will be voted FOR the approval of the compensation of our named executive officers. Asvoted:

| ● | “FOR ALL” of the Board’s highly qualified and very experienced nominees to be elected to serve on the Board until the 2027 Annual Meeting of Stockholders and until their successors are duly elected and qualified or until their earlier death, resignation, or removal (Proposal 1); | |

| ● | “FOR” the ratification of the appointment of Baker Tilly US, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024 (Proposal 2); | |

| ● | “FOR” the approval of an amendment to the Company’s charter to provide for the reclassification of any unissued shares of common stock from time to time into one or more classes or series of stock having such terms as determined by the Board of the Company (Proposal 3); and | |

| ● | “FOR” the approval of an amendment to the Company’s charter to eliminate cumulative voting in the election of directors (Proposal 4). |

If any other business which maymatters properly come before the SpecialAnnual Meeting, the individuals named as proxies on the enclosed proxy card, or their duly constituted substitutes or re-substitutes acting at the Annual Meeting, will be authorized to vote or otherwise act thereon in accordance with their discretion on such matters to the extent authorized by Rule 14a-4(c) of the Securities Exchange Act of 1934, as amended.

What if my shares of common stock are held in “street name” by my broker?

Please be sure to give specific voting instructions to your broker, bank, or other nominee so that your vote can be counted. If you hold your shares of common stock in the name of your broker, bank, or other nominee and wish to vote at the Annual Meeting, you must contact your broker, bank, or other nominee and request a document called a “legal proxy.” You must obtain this legal proxy in order to vote at the Annual Meeting. Even if you plan to attend the Annual Meeting, management strongly recommends that you vote your shares prior to attending the meeting.

If you are a beneficial owner of shares held in “street name” and do not provide the organization that holds your shares with specific voting instructions, then the organization that holds your shares may generally vote on “routine” matters but cannot vote on “non-routine” matters, as determined by applicable SEC and NYSE rules. A “broker non-vote” occurs when there are both routine and non-routine matters on the proxy card, and the broker marks a vote on the routine matter (either as instructed by the client or, if not instructed, in the broker’s discretion) and crosses out those non-routine matters on which it has no voting authority without the client’s instruction.

Each of Proposal 1, Proposal 3, and Proposal 4 included in the Proxy Statement is generally considered a non-routine matter, and therefore brokers, banks, and other nominees will not have discretionary authority to vote your shares of common stock on these proposals if you do not provide them with specific voting instructions.

The approval of the ratification of the appointment of Baker Tilly US, LLP as our independent registered public accounting firm (Proposal 2) is considered by the NYSE to be a “routine” matter. As such, your broker, bank, or other nominee will have discretionary authority to vote your shares of common stock with respect to Proposal 2 without voting instructions from you. Accordingly, broker non-votes will not be applicable to Proposal 2. However, please be advised that it is possible that a broker, bank, or other nominee may choose not to exercise discretionary authority with respect to Proposal 2. In that case, if you do not instruct your broker, bank, or other nominee how to vote your shares of common stock with respect to Proposal 2, it is possible that such broker, bank, or other nominee may choose not to vote your uninstructed shares with respect to Proposal 2 and, accordingly, such uninstructed shares would not be voted or counted for determining whether a quorum exists at the Annual Meeting.

| 8 |

Where will I be able to find voting results of the Annual Meeting?

Voting results will be tallied by the inspector of election. Presidio will report the official voting results in a Current Report on Form 8-K, to be filed with the U.S. Securities and Exchange Commission (the “SEC”) within four business days following the Annual Meeting. If the official results are not available at that time, Presidio will provide preliminary voting results in the Form 8-K and will provide the final results in an amendment to the Form 8-K as soon as they become available.

How can I vote my shares of common stock?

Whether you are a stockholder of record or a beneficial owner holding any of your shares of common stock in “street name,” such as in a stock brokerage account with a broker or through a bank or other nominee, you may vote in the following ways:

By Phone:

Vote by dialing the number on the proxy card or voting instruction form and following the easy voice prompts.

By Internet;

Follow the instructions included on the proxy card or voting instruction form.

At the Virtual Annual Meeting:

Attend the virtual Annual Meeting and be submitted tovote your shares electronically during the meeting. If you hold any shares in “street name,” you may not vote at the meeting unless you obtain a votelegal proxy from the organization that holds your shares.

By Mail

If you request printed copies of the stockholders, proxies receivedproxy materials by mail, you will receive a proxy card and you may vote the Board of Directors will be votedproxy by filling out the proxy card and returning it in the discretion ofenclosed postage-paid envelope.

Even if you plan to attend the namedvirtual Annual Meeting, we encourage you to vote your shares on the proxy holders.

Attendancecard TODAY by Internet or mail to ensure that your votes are counted at the Special MeetingAnnual Meeting.

The deadline for voting via the Internet or by telephone will not revoke a previously submittedvary depending upon how you vote your shares. Please follow the instructions shown on your proxy unless you actually vote in person at the meeting. For shares you hold beneficially in street name, you may change your vote by submitting a newcard or voting instruction form.

If you are not the stockholder of record, please refer to the voting instructions provided by your bank, broker, or other nominee followingto direct it how to vote your shares on the instructions they provided, or,voting instruction form. Your vote is important. You are also invited to attend the Annual Meeting. However, if you have obtainedare not the stockholder of record, you may not vote these shares electronically at the Annual Meeting unless you obtain a legal proxy from your broker or other nominee givingthe stockholder of record authorizing you the right to vote the shares of common stock.

Certain of our stockholders hold their shares in more than one account and may receive separate proxy cards or voting instruction forms for each of those accounts. To ensure that all of your shares are represented at the Annual Meeting, we recommend that you submit every proxy card or voting instruction form you receive.

| 9 |

OUR BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR ALL” OF PRESIDIO’S NOMINEES (DAVID T. BRUEN AND STEVE HIGHTOWER).

Can I change my vote after I have mailed in my proxy card(s) or submitted my vote via the Internet or by attending the Special Meeting and voting in person.telephone?

If you are a stockholder of record, you may revoke ayour proxy at any time before it is voted ator change your vote prior to the SpecialAnnual Meeting by:

|

|

|

|

|

| |

| ● | Signing, dating, and returning a new proxy card or voting instruction form with | |

| ● | Signing, dating, and mailing an instrument revoking the proxy to the attention of the Secretary, Presidio Property Trust, Inc., 4995 Murphy Canyon Road, Suite 300, San Diego, California 92123; or | |

| ● | Voting electronically at the Annual Meeting. |

The expenseIf you are a beneficial owner of soliciting proxies, including the cost of preparingyour shares and mailing the Notice of Internet Availability of Proxy Materials for the Stockholders Meeting,you have instructed your bank, broker, or other nominee to vote your shares, you may change your vote prior to the Annual Report,Meeting by following directions provided by your bank, broker, or other nominee to change such voting instructions. If you hold shares in “street name,” your attendance at the Annual Meeting will not revoke your voting instructions. In the absence of a revocation, shares represented by proxies will be voted at the Annual Meeting.

How will my proxy be voted?

If you complete, sign, date, and return your proxy card(s) or vote via the Internet or by telephone, your proxy will be voted in accordance with your instructions. If you are a stockholder of record, and you sign and date your proxy card(s) but do not indicate how you want to vote, your shares of common stock will be voted as our Board unanimously recommends for each of the proposals. If you are a beneficial owner (i.e., a “street name” stockholder), and you sign and date your proxy card(s) but do not indicate how you want to vote, then the organization that holds your shares of common stock may generally vote on “routine” matters (also referred to as “discretionary matters”) but cannot vote on “non-routine” matters (also referred to as “non-discretionary matters”), as determined by applicable SEC and NYSE rules. Please see “What if my shares of common stock are held in “street name” by my broker?” above.

Who may attend the Annual Meeting?

Attendance at the virtual Annual Meeting will be limited to stockholders as of the Record Date, their proxy holders, and invited guests of Presidio. Access to the Annual Meeting may be granted to others at the discretion of Presidio and the costchair of the Annual Meeting. To attend the Annual Meeting, you must pre-register at www.https://agm.issuerdirect.com/sqft by 8:15 A.M., Pacific Time on June 27, 2024.

Please have your voting instruction form, proxy card, or other communication containing your control number available and follow the instructions to complete your registration request. If you are a beneficial holder, you must obtain a “legal proxy” from your broker, bank, or other nominee to vote during the Annual Meeting. Upon completing registration, participants will receive further instructions via email, including unique links that will allow them to access the meeting.

Even if you plan to attend the Annual Meeting, we strongly urge you to vote in advance either by completing, signing, and dating the enclosed voting instruction form or proxy card and returning it in the postage-paid envelope provided or by voting via the Internet andor by telephone, posting and votingas soon as possible. This will ensure your vote will be paid bycounted if you later are unable or decide not to attend the Company. In addition to solicitation by mail, our directors, officers and employees and representatives from RR Donnelly, P.O. Box 932721, Cleveland, OH 44193 and Mediant Communications, 3 Columbus Circle, Suite 2110, New York, NY 10019, Annual Meeting.may solicit proxies by telephone, Internet or otherwise. Our

directors, officers and employees will not be additionally compensated for the solicitation, but may be reimbursed for their out-of-pocket expenses. The Company will pay RR Donnelly and Mediant Communications a fee to maintain the Internet and telephone voting services and, if necessary, perform the solicitation of proxies. Brokerage firms, fiduciaries and other custodians who forward soliciting material to the beneficial owners of shares held of record by them will be reimbursed for their reasonable expenses incurred in forwarding such materials. Is my vote confidential?

CONFIDENTIALITY

The Company will keep all the proxies,Proxy instructions, ballots, and voting tabulations private, except as necessarythat identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within Presidio or to meet applicable legal requirements. Wethird parties, except:

| ● | As necessary to meet applicable legal requirements; | |

| ● | To allow for the tabulation and certification of votes; and | |

| ● | To facilitate a proxy solicitation. |

Who is paying the costs of the proxy solicitation?

Presidio will permitbear the Inspectorcost of Electionsthe proxy solicitation by it and our outside legal counselBoard, including amounts paid to examine these documents. banks, brokers, proxy solicitors, and other record owners to reimburse them for their expenses in forwarding solicitation materials regarding the Annual Meeting to beneficial owners of common stock. For additional information regarding the cost of this solicitation, please see the section “Solicitation of Proxies” in this Proxy Statement.

How will proxies be solicited?

The Company will, however, disclosesolicitation of proxies may occur by mail, facsimile, telephone, email, internet, including social media platforms, text messages, other electronic means, personal contact, and by advertisements. Our directors, officers, and regular employees (at no additional compensation) may participate in the total votes received for and against each proposalsolicitation of proxies from stockholders. Morrow Sodali, a proxy solicitation firm, has been retained by the Board to assist it in a Form 8-K filing following the Special Meeting as required by law.

ELECTRONIC DELIVERY OF COMPANY STOCKHOLDER COMMUNICATIONS

Company stockholderssoliciting proxies. For additional information regarding how proxies will be able to viewsolicited, please see the section “Solicitation of Proxies” in this Proxy StatementStatement.

Who should I call if I have questions about the Annual Meeting?

If you have any questions or require assistance voting, or if you need additional copies of the proxy materials, please contact Morrow Sodali, our proxy solicitation firm, at:

509 Madison Avenue Suite 1206

New York, NY 10022

Stockholders Call Toll Free: (800) 662-5200

Banks, Brokers, Trustees, and Annual Report over the Internet at www.proxydocs.com/NetREIT in addition to receiving paper copies in the mail. Please follow the instructions provided in your Proxy Materials and on your proxy card or the instructions provided when you authorize your vote over the Internet by going to the website www.proxypush.com/NetREIT.Other Nominees Call Collect: (203) 658-9400

Email: SQFT@investor.MorrowSodali.com

Important Notice Regarding the Availability of Proxy Materials for the StockholdersAnnual Meeting

to Be Held at 8:30 A.M., Pacific Time, on November 21, 2016. June 27,2024.

The Notice of the 2024 Annual Meeting of Stockholders, this Proxy Statement,

the accompanying proxy card and our Annual Report to stockholders are available at www.proxydocs.com/NetREIT.on Form 10-K for

ANNUAL REPORT AND FINANCIAL STATEMENTS OF THE COMPANY

The annual report of the Company, containing financial statements for the fiscal year ended December 31, 2015,2023 are available at

https://www.presidiopt.com

PROPOSAL 1

ELECTION OF DIRECTORS

Pursuant to the Presidio Bylaws and as fixed by our Board of Directors, the number of members of the Board is includedcurrently set at seven directors.

On March 18, 2024, the Company filed Articles Supplementary (“Articles Supplementary”) relating to the Company’s election to be subject to Section 3-803 of the MGCL with the State Department of Assessments and Taxation of Maryland. The Articles Supplementary classified the Board into three classes with directors serving three-year terms, with such classes designated Class I, Class II, and Class III. The term of the Class I directors shall last until the Annual Meeting and until their successors are elected and qualified. The term of the Class II directors shall last until the 2025 Annual Meeting of Stockholders and until their successors are elected and qualified. The term of the Class III directors shall last until the 2026 Annual Meeting of Stockholders and until their successors are elected and qualified. At each annual meeting of the stockholders of the Company, the successors to the class of directors whose term expires at that meeting shall be elected to hold office for a term continuing until the annual meeting of stockholders held in the third year following the year of their election and until their successors are elected and qualified. The Class I directors consist of David T. Bruen and Steve Hightower, the Class II directors consist of Jennifer A. Barnes and Tracie Hager, and the Class III directors consist of Jack K. Heilbron, James R. Durfey, and Elena Piliptchak.

At the Annual Meeting, you will be asked to elect two (2) directors to the Board who are classified into Class I. The following current directors have been nominated for re-election at the Annual Meeting as Class I directors: David T. Bruen and Steve Hightower. Each of the nominees recommended by the Board has consented to serving as nominees for election to the Board, to being named in this Proxy Statement, and is availableto serving as members of the Board if re-elected at www.proxydocs.com/NetREIT.

PROPOSALS ON WHICH YOU MAY VOTE

WHETHER YOU PLAN TO ATTEND THE SPECIAL MEETING AND VOTE IN PERSON OR NOT, WE URGE YOU TO HAVE YOUR VOTE RECORDED. STOCKHOLDERS MAY SUBMIT THEIR PROXIES VIA THE INTERNET AT WWW.PROXYPUSH.COM/NETREIT OR VIA TELEPHONE AT 1-866-249-5360.

PROPOSAL 1the Annual Meeting. As of the date of this Proxy Statement, the Company has no reason to believe that any of the Board’s nominees will be unable or unwilling to serve if elected as a director. However, if for any reason any of the Board’s nominees become unable to serve or for good cause will not serve if elected, the Board, upon the recommendation of its Nominating and Corporate Governance Committee, may designate substitute nominees, in which event the shares represented by proxies returned to us will be voted for such substitute nominees. If any substitute nominees are so designated, the Company will file an amended proxy statement that, as applicable, identifies the substitute nominees, discloses that such nominees have consented to being named in the amended proxy statement and to serve as directors if elected, and includes certain biographical and other information about such nominees required by the applicable rules promulgated by the SEC.

ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street ReformFor your review and Consumer Protection Act (the Dodd-Frank Act) provides our stockholders with the opportunity to consider and vote upon, onconsideration, a non-binding, advisory basis, the compensationbiography of our named executive officers as disclosedeach nominee for director is contained in this Proxy Statement pursuant to the compensation disclosure rules of the Securities and Exchange Commission.

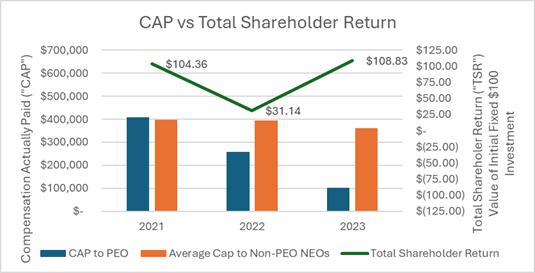

As described in detail under the heading “Compensation Narrative,section titled “Director Nominee Biographies.” we seek to closely align the interests of our named executive officers with the interests of our stockholders. Our compensation programs are designed to reward the achievement of specific annual, long-term and strategic goals by the Company and to align executives’ interests with those of the stockholders by rewarding performance above established goals with the ultimate objective of improving stockholder value.

We encourage you to carefully review the section of this Proxy Statement titled “Compensation Narrative” for additional details on our executive compensation program as well as the reasons and processes for how our Compensation Committee determined the structure and amounts of the 2015 compensation of our named executive officers.

We are asking our stockholders to indicate their support for the compensation of our named executive officers asEach Class I director nominee set forth in this Proxy Statement. Accordingly, we are asking our stockholders to vote “FOR” the following resolutionStatement and elected at the SpecialAnnual Meeting will serve until the 2027 Annual Meeting of Stockholders and until such individual’s successor is duly elected and qualified.

Unless otherwise specified, if you sign and return the enclosed proxy card, it will be voted “FOR ALL” of our Board’s highly qualified and very experienced nominees to be elected to serve on the Board until the 2027 Annual Meeting of Stockholders and until their successors are duly elected and qualified: David T. Bruen and Steve Hightower.

Cooperation Agreement with Zuma Capital Management, LLC

On May 9, 2024, the Company entered into a cooperation agreement (the “Cooperation Agreement”) with Zuma Capital Management, LLC (“Zuma”) and certain individuals and entities named on the signature pages thereto (such individuals and entities, collectively and together with Zuma, the “Investor Group,” and the Investor Group, together with the Company, the “Parties”) with respect to the composition of the Board, the Annual Meeting), and certain other matters, as provided in the Cooperation Agreement.

Pursuant to the Cooperation Agreement, Zuma has irrevocably withdrawn the letter it submitted notifying the Company of its intent to nominate certain director candidates to the Board at the Annual Meeting (such letter, as supplemented from time to time, the “Nomination Notice”), and has agreed to cease all solicitation efforts in connection with the Annual Meeting.

“RESOLVED,The Cooperation Agreement was effective upon its execution and terminates on the date on which results for the Company’s 2026 annual meeting of stockholders (including any and all adjournments, postponements, and continuations thereof, the “2026 Annual Meeting”) are certified; provided, however, that if the Company re-nominates the New Director (as defined below) or any Replacement Appointee (as defined below) at the 2026 Annual Meeting, the termination date of the Cooperation Agreement will be automatically extended until the date that the stockholdersNew Director or any Replacement Appointee, as applicable, is no longer a member of NetREIT, Inc. approve, onthe Board (the “Termination Date”).

Pursuant to the Cooperation Agreement, the Company has increased the size of the Board from six to seven directors and appointed Ms. Piliptchak (the “New Director”) as a Class III director to the Board, with an advisory basis,initial term expiring at the compensation2026 Annual Meeting.

Pursuant to the Cooperation Agreement, the Company has agreed that, during the period from the date of NetREIT’s named executive officers,the Cooperation Agreement to the Termination Date, the New Director will be given the same due consideration for membership to each committee of the Board as disclosed in this Proxy Statementany other independent director, and within 14 days of the date of the Cooperation Agreement, the New Director will be appointed to at least two (2) of the Board’s committees, including the Nominating and Corporate Governance Committee and that the second committee appointment will be to the Audit Committee, the Compensation Committee, or a newly constituted Strategy Committee; provided that, with respect to such committee appointment(s), the New Director is and continues to remain eligible to serve as a member of such committee pursuant to Item 402applicable law, rule, or regulation (including those of the SEC and Nasdaq which are applicable to such committee.

Pursuant to the Cooperation Agreement, the New Director is entitled to the same director benefits as the other non-employee members of the Board and.is required to comply with the Company’s charter, bylaws, committee charters, and corporate governance, ethics, conflict of interest, confidentiality, Regulation S-K,FD, stock ownership and trading policies and guidelines and similar corporate governance documents, policies, processes, codes, rules, standards and guidelines in each case as currently in effect and as amended from time to time (collectively, the “Company Policies”).

If the New Director or any Replacement Appointee (as defined below) is unable or unwilling to serve as a director for any reason or resigns or is removed as a director prior to the Termination Date and at such time the Investor Group maintains an aggregate beneficial ownership of at least three percent (3%) of the Company’s then outstanding shares of Series A Common Stock (“Common Stock”), Zuma has the ability to identify and propose a replacement therefor (and will consider in good faith any proposed replacements suggested by the Company), which the Board will, in good faith, accept or reject. If there is a rejection, Zuma will have the right to continue to identify and propose replacement candidates until a replacement is mutually agreed upon by the Company and Zuma (any such replacement, the “Replacement Appointee”) for appointment to the Board. Such Replacement Appointee must (i) be reasonably acceptable to the Board; (ii) be qualified to serve as a member of the Board under all Company Policies and applicable legal and regulatory requirements; (iii) meet the independence requirements with respect to the Company of the listing rules of the Nasdaq and all applicable rules of the SEC; (iv) have complied with the Company’s procedures for new director candidates (including the full completion of a directors’ and officers’ questionnaire, undergoing a customary background check, and participating in interviews with the members of the Nominating and Corporate Governance Committee and/or other members of the Board); (v) have no then existing or past material relationship with any member of the Investor Group or any Affiliate (as defined in the Cooperation Agreement) or Associate (as defined in the Cooperation Agreement) thereof (as determined in good faith by the Board); and (vi) serve on no more than a total of three other public company boards.

Pursuant to the Cooperation Agreement, the Investor Group and its Representatives (as defined in the Cooperation Agreement) have agreed that, until the Termination Date, they will comply with customary standstill restrictions, including, among others, with respect to proxy contests, other activist campaigns, books and records demands, share purchases and related matters, including that the compensation tableseach individual member of the Investor Group, together with their respective Affiliates and Associates, cannot acquire beneficial ownership or economic exposure of shares of the Company’s Common Stock to the extent that such ownership of the Investor Group, in the aggregate (whether beneficial ownership, economic exposure, or a combination thereof), exceeds 8.0% of the Company’s outstanding Common Stock.

In the Cooperation Agreement, each Party has agreed not to threaten or initiate legal proceedings against the other Party or to knowingly encourage, solicit, or assist any related disclosure set forth in this Proxy Statement.”person to threaten or initiate legal proceedings against the other Party prior to the Termination Date.

The vote on this resolution is not intended to address any specific element of compensation; rather,Cooperation Agreement contains customary mutual non-disparagement provisions which prohibit each Party from making disparaging statements regarding the vote relatesother Party or its respective Representatives prior to the compensationTermination Date.

Additionally, each member of our named executive officers, as described in this Proxy Statementthe Investor Group has agreed to vote, solely on the Company’s proxy, voting instruction, or consent card, all shares of the Company’s Common Stock owned by it or any of its Affiliates or Associates, including shares acquired after the date of the Cooperation Agreement, (i) at the 2024 Annual Meeting in accordance with the compensation disclosure rulesBoard’s recommendations as set forth in the Company’s definitive proxy statement, and (ii) at any meeting, or any action by written consent, of the SecuritiesCompany’s stockholders, that occurs prior to the Termination Date, in accordance with the Board’s recommendations with respect to (a) the election, removal or replacement of directors of the Company, and Exchange Commission. The(b) any other proposal submitted to shareholders; provided, however, that in the event Institutional Shareholder Services Inc. (“ISS”) or Glass Lewis & Co., LLC (“Glass Lewis”) recommends otherwise with respect to any proposals (other than with respect to the election, removal, and/or replacement of directors), the Investor Group will be permitted to vote is advisory, which meansin accordance with the ISS or Glass Lewis recommendation; provided, further, that the Investor Group will be permitted to vote in its sole discretion with respect to any Extraordinary Transaction (as defined in the Cooperation Agreement) submitted for stockholder approval that would result in a change of control of the Company.

Pursuant to the Cooperation Agreement, the Company has agreed to reimburse the Investor Group up to $100,000 for the Investor Group’s reasonably incurred and documented out-of-pocket fees and expenses (including legal fees) incurred in connection with the Investor Group’s investment in the Company, including, but not limited to, the Investor Group’s preparation of the Nomination Notice and negotiation and execution of the Cooperation Agreement and related activities.

The foregoing summary of the Cooperation Agreement does not purport to be complete and is not bindingsubject to, and qualified in its entirety, by reference to the full text of the Cooperation Agreement, a copy of which is filed as Exhibit 10.1 to a Current Report on Form 8-K filed by the Company with the SEC on May 10, 2024.

DIRECTOR NOMINEES

Our Board consists of a diverse group of highly experienced and accomplished leaders in their respective fields. The following table provides summary information about the Board’s director nominees standing for election at the Annual Meeting, each of whom is currently a member of the Board. Detailed information about each director nominee’s background, skill set, and areas of experience can be found beginning on page 17 of this Proxy Statement.

Set forth below are the names of the individuals nominated as directors, their ages, their offices in the Company, if any, their principal occupations or employment for at least the past five years, the length of their tenure as directors, and the names of other public companies in which such persons hold or have held directorships during the past five years.

| 13 |

The table below provides the skills and qualifications of each director nominee. The director qualifications currently focus on what the Nominating and Corporate Governance Committee believes to be essential competencies to effectively serve on the Company,Board in conjunction with the director qualification standards and selection criteria outlined by the Company’s Corporate Governance Guidelines. In reviewing and considering potential nominees for the Board, the Nominating and Corporate Governance Committee reviewed the candidate’s experience in corporate management, such as serving as an officer or former officer of a publicly held company, the candidate’s experience as a board member of a publicly held company, the candidate’s professional and academic experience relevant to the Company’s industry, the strength of the candidate’s leadership skills, the candidate’s experience in finance and accounting and/or executive compensation practices, and whether the candidate has the time required for preparation, participation and attendance at Board meetings and committee meetings, as well as the candidate’s geographic background, gender, age and ethnicity. The Nominating and Corporate Governance Committee and the Board have concluded that each of the nominees for election to the Board should serve as a member of the Board at the time of filing the Proxy Statement.

| David T. Bruen | Steve Hightower | |||||||

| Financial and Accounting expertise | X | |||||||

| Multi-industry/Corporate Management experience | X | X | ||||||

| Real Estate experience | X | X | ||||||

| Human Resources and Compensation Practices experience | ||||||||

| Director, officer or former officer of public company | ||||||||

| Officer or former officer of emerging company | ||||||||

| Community Involvement | X | X | ||||||

| Personal and Professional Integrity, Ethics and Values | X | X | ||||||

DIRECTOR NOMINEE BIOGRAPHIES

Name (Age)

David T. Bruen (79)

Mr. Bruen has served as our Lead Independent Director since May 2020 and Chair of our Audit Committee until January 2023. Mr. Bruen joined our Board of Directors in 2008 and has served as a member of the Audit Committee since 2010. Mr. Bruen retired in 2008 from San Diego National Bank after six years as a senior commercial lending officer. During the previous 17 years, Mr. Bruen was in commercial lending for mid-size businesses in San Diego County for First Interstate Bank, Wells Fargo Bank, Mellon 1st Business Bank, and San Diego National Bank. He is a Life Member of the Holiday Bowl Committee and has been a member of the Presidents Association for Palomar College, Financial Executives International, the San Diego MIT Enterprise Forum, and the Association for Corporate Growth. Mr. Bruen is a graduate of San Diego State University and has an M.B.A. from the University of Southern California. Based on his experience with banks, his educational background, and his achievements in the community, the Nominating and Corporate Governance Committee determined that Mr. Bruen is qualified to serve on the Board of Directors.

Steve Hightower (56)

Mr. Hightower currently serves as the President of the Company’s Model Home division since December 2021 and served as the Vice President of our subsidiary NetREIT Advisors, LLC from March 2010 through December 2021. He is responsible for overseeing the Company’s model home division including acquisitions, resales, and management of its residential real estate portfolio. Prior to joining the Company, Mr. Hightower held the position of Executive Vice President of Dubose Model Homes, USA, a model home real estate investment company, where he was responsible for its model home assets, including property acquisitions, divestment, as well as builder and banking relations. He has over 26 years of experience in real estate specializing in model home related transactions. Prior to joining Dubose Model Homes in 1996, he held various positions within Exxon Company USA. Mr. Hightower holds a B.A degree in Business Administration from Texas State University. Based on his perspective and experience he brings as a key executive, the Nominating and Corporate Governance Committee determined that Mr. Hightower is qualified to serve on the Board of Directors.

OTHER DIRECTOR BIOGRAPHIES

Name (Age)

Jennifer A. Barnes (44)